The world sneezes and the UK catches a cold

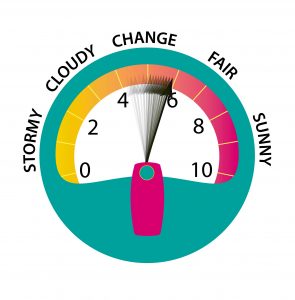

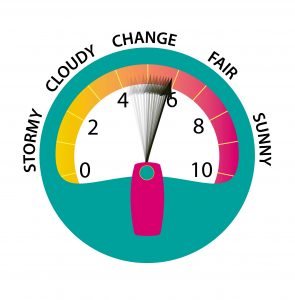

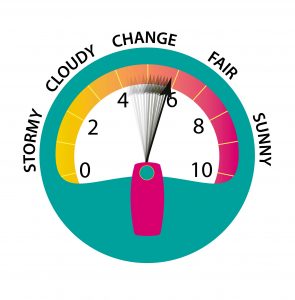

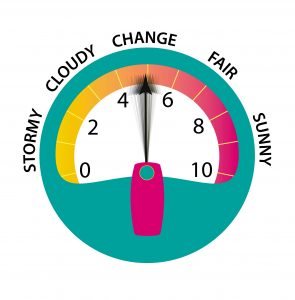

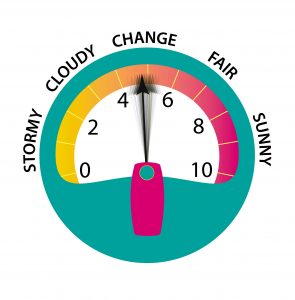

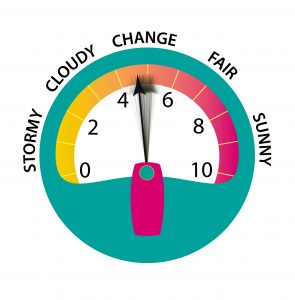

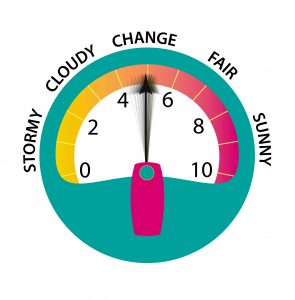

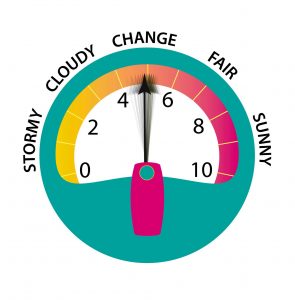

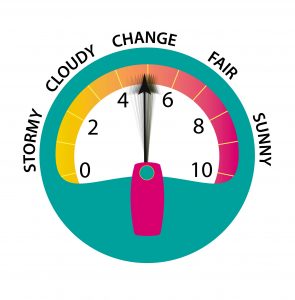

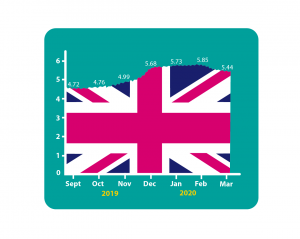

Last month we warned that the record level of the UK’s well-being needed to be re-visited once the impact of the coronavirus had been assessed… and look what has happened since! The outbreak has dominated the media and infected business confidence around the world. It is still early days in the development of the virus, but already the Accountagility Index (AAX) has lost 41 basis points this month, falling to 5.44, from a peak of 5.85 in February. Any score above 5.00 is positive, so overall the UK is still doing well. The AAX is still the only measure of the UK’s overall health, both economic and political.

See below for more detailed analysis, or watch an interview with our Brexometer guru David West laying out the context.

So what factors caused the Index to go down this month?

The overwhelming negative factor was the drop in the UK markets, with both FTSE 100 and FTSE 250 (mid-caps) falling by around the same ratio. This one factor has dominated the Index, accounting for most of the downward change. All of this is down to a loss of confidence in the global economy to continue with Business As Usual over the coming months. Demand in Asia, lengthening supply chains, and reduced domestic consumer demand in areas such as travel and entertainment, are all cited as contributory concerns. Inflation also rose sharply, and may be impacted by supply side factors and consumer stockpiling. GDP has held up and was set for a positive 2020 outlook, but this is now compromised, in the short term at least.

What were the other factors?

There were positives too; sentiment rose, due to the lifting of uncertainty from Brexit and from a clear General Election result. For the first time in ten months, all three UK sectors are now in the positive (above 50 out of 100), with the Construction sector showing the strongest rebound. The UK debt ratio dropped below 80% to record its most positive level since August 2016. That’s a good platform for dealing with the turbulence ahead.

All COVID-19 news has rather put the important UK-EU trade negotiations into the shade. Over recent weeks, the two sides have set out their stalls and warned each other of the dire impacts of failing to agree a deal. To get a deal done by the target date of the end of this year, all the key negotiating items need to be agreed at a high level by June. We await this date with bated breath but there’s no great expectation that such a timetable is feasible. Perhaps a positive mind-set in these talks could go viral too!

How is the economy looking?

It’s also been impacted by the outbreak. In pure economic terms, the Index fell 55 basis points from 6.07 last month, to 5.52, a large fall but still well into the black. Over the course of the next few years, HS2 going ahead will have a positive impact on the UK, especially in the Construction sector. Good news amongst the gloom.

What happens next?

The next Brexometer measurement will be taken early in April 2020, when a lot more about the Coronavirus on the UK economy will be known. We will also see how the two sides are getting along with the EU trade negotiations. How will UK investment and confidence perform in the face of these factors? How will other factors affect the Index? How will the economy react? Keep following the Brexometer to find out.

Join in!

There is a free competition open to everyone, to predict each month’s score. This month’s winner is our very own Tom Crosby, who came closest to the correct score with his prediction. Well done Tom! It was a difficult month to forecast, but you have won the special prize, a Brexometer tenner with the serial number starting AA20 to mark the year 2020. Next month would you like to join in? The Index will be measured again early next month, on 9th April, just ahead of the Easter break. We have yet another special Brexometer tenner to win, with the serial number AA01, which is super rare to say the least. The winner will also receive a framed certificate to show off their awesome punditry to colleagues and friends. Just email with your own prediction (a score out of ten to two decimal places), and this special keepsake could be yours… or you could just spend it!