Deal or no deal? We’re holding our breath…

But the UK is actually doing okay. Whilst Parliament, the Government, the legislature and the EU have been contributing to a feverish and emotion-charged few weeks, the UK economy has actually improved. What is going on, you ask? And what on earth is going to happen next? It’s tiring enough just reading the headlines!

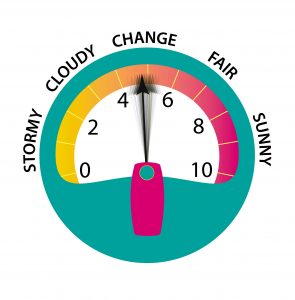

Despite the political twists and turns, the Accountagility Index (AAX) rose by 4 basis points this month, from 4.72 in September to 4.76 The Index records UK political and economic health in a score out of ten. Any score below 5.00 is negative, so we remain in the red rather than in the black this month, as indeed we have since May (the month not the leader!).

So what caused the Index to go up this month?

There were two highly positive factors at play since last time; inward investment rose by an astonishing 9% to an all-time high, whilst inflation fell. In the case of the CPI (Consumer Price Index), there was a healthy fall of 40 basis points to land at 1.7%, but the RPI also showed a fall of 20 bps, to 2.6%. A note of caution though, friends. Both of these factors are essentially lagging indicators, and do not provide a sound basis for future assumptions. There are some malign influences at work that will move inflation upwards over the coming weeks, mainly the weakness of sterling, which is already impacting input costs including fuel. The other positive contribution was made by the fall of 1.5% in the UK debt ratio, which is heading back down towards 80% quite quickly.

But there was plenty of bad news too, wasn’t there?

Absolutely! Economically there were modest falls in the markets and in sterling. The biggest worry is what sentiment across all three key UK sectors is telling us. Construction is stuck in a ditch, and won’t be dug out for a few months, by the look of it. The important PMI Index records a confidence score of 43.3 (out of 100), and is seeing ten year lows in employment, new orders and building activity. Even the traditionally reliable Services sector fell into the red, with a score of 49.5, the worst since the post-Referendum shock, and is shedding workers through non-replacement of leavers. The surprising positive was in Manufacturing, which blipped upwards after 4 months of falls. This was due to Brexit preparations, similar to the rise we observed ahead of the last Brexit date of late March earlier in the year. This time the advanced ordering and stocking up is more modest, but it is likely that this trend will sharpen this month and protect the UK from the worst of fall-out from the (current) 31st October exit deadline.

Of course the political considerations were pretty much all negative. Parliament was re-called after the legal judgment declared the extended proroguement illegal, but there has been no tangible progress in the Commons chamber, as far as the populace can see. There is no majority in Parliament, but no immediate Election either, and the temperature of the Brexit negotiations is hardly encouraging. The likelihood of a No Deal exit is still high, and expectations are similarly elevated for a General Election being called before Christmas.

What else has been happening?

For economics junkies, the Index for economic factors only, rose by a hefty 15 basis points from 5.41 last month, to 5.56. This is encouraging, and heading back towards the all-time peak of 5.93 in April.

What happens next?

The next Brexometer release will be in early November, after the Halloween date that currently represents the UK’s departure from the EU. Will that happen? How can Boris prevent a further extension, as he appears committed to do? Will he write the letter to the EU asking for another three months, or will it be a judge? How will the EU reply? If the UK does leave, will planes fall out of the sky, will trains run on time and will Kent experience the world’s longest ever traffic jam? How will all of this affect the economy? How will the Index react? Keep following the Brexometer to find out.

Join in!

This year we have set up a competition open to everyone, to predict each month’s score. October’s winner is our colleague Mahir Khalid, who won this month’s competition with a totally precise forecast. Well done Mahir! He has won the special prize; a Brexometer tenner with the serial number starting AA, one of the first new plastic ten pound notes ever printed. Next month would you like to join in? The Index could be heading anywhere, so it will be an open field. Because of the seismic events that could drive the Brexometer haywire over the coming month, which will make predictions a real challenge, we have an amazing and even rarer Brexometer tenner to win, which has the serial number AK47. It is a very rare and prized note and completely appropriate for the times we are living through! The winner will also receive a framed certificate to show off their awesome punditry to colleagues and friends. Just email your own prediction (a score out of ten to two decimal places), and this special keepsake could be yours… or you could just spend it!