The introduction of the International Financial Reporting Standard IFRS 17 has brought significant changes to the insurance industry. It necessitates the measurement of insurance contracts using updated estimates and assumptions that provide transparent reporting on financial position and risk. As insurance companies adapt to this new standard, it becomes crucial for them to find solutions that streamline their compliance processes while ensuring consistency, transparency, and compatibility. In this blog post, we will explore how the ORYX solution from Accountagility supports insurance companies in meeting the requirements of IFRS 17. And how you can experience automation, integration, and accuracy in financial reporting.

What is IFRS 17?

It is a global accounting standard introduced by the International Accounting Standards Board (IASB) to provide a consistent framework for reporting insurance contracts. It aims to enhance comparability, transparency, and understanding of insurers’ financial statements. The standard outlines comprehensive requirements for the recognition, measurement, presentation, and disclosure of insurance contracts, addressing areas such as revenue recognition, contract liabilities, and cash flows.

How does the ORYX Solution help IFRS 17?

Accountagility, a leading provider of financial management solutions, offers a solution that supports insurance companies in complying with this standard.

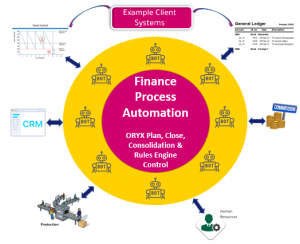

ORYX is a comprehensive platform that automates various aspects of compliance reporting, ensuring accuracy and efficiency throughout the process.

ORYX facilitates Automatic IFRS 17 Journal Production and Postings

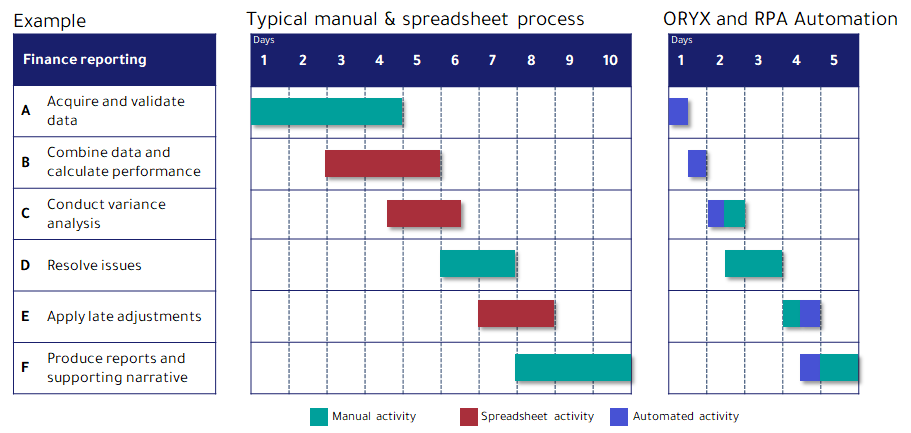

One of the significant challenges in complying with this standard is the production and posting of multiple accounting adjustments. ORYX’s IFRS journal solution streamlines this process by automating the production and posting of journals back to the general ledger (GL). This automation eliminates manual errors, reduces time-consuming tasks, and improves overall accuracy.

Integration Across Finance Systems

ORYX seamlessly integrates with finance enterprise resource planning (ERP) systems, actuarial datasets, and underwriting systems. This integration ensures smooth data flow between various systems, eliminating silos and improving data accuracy. By consolidating data from multiple sources, ORYX provides a holistic view of financial information, enabling comprehensive reporting and analysis.

Instant Production of Finalised PL and BS

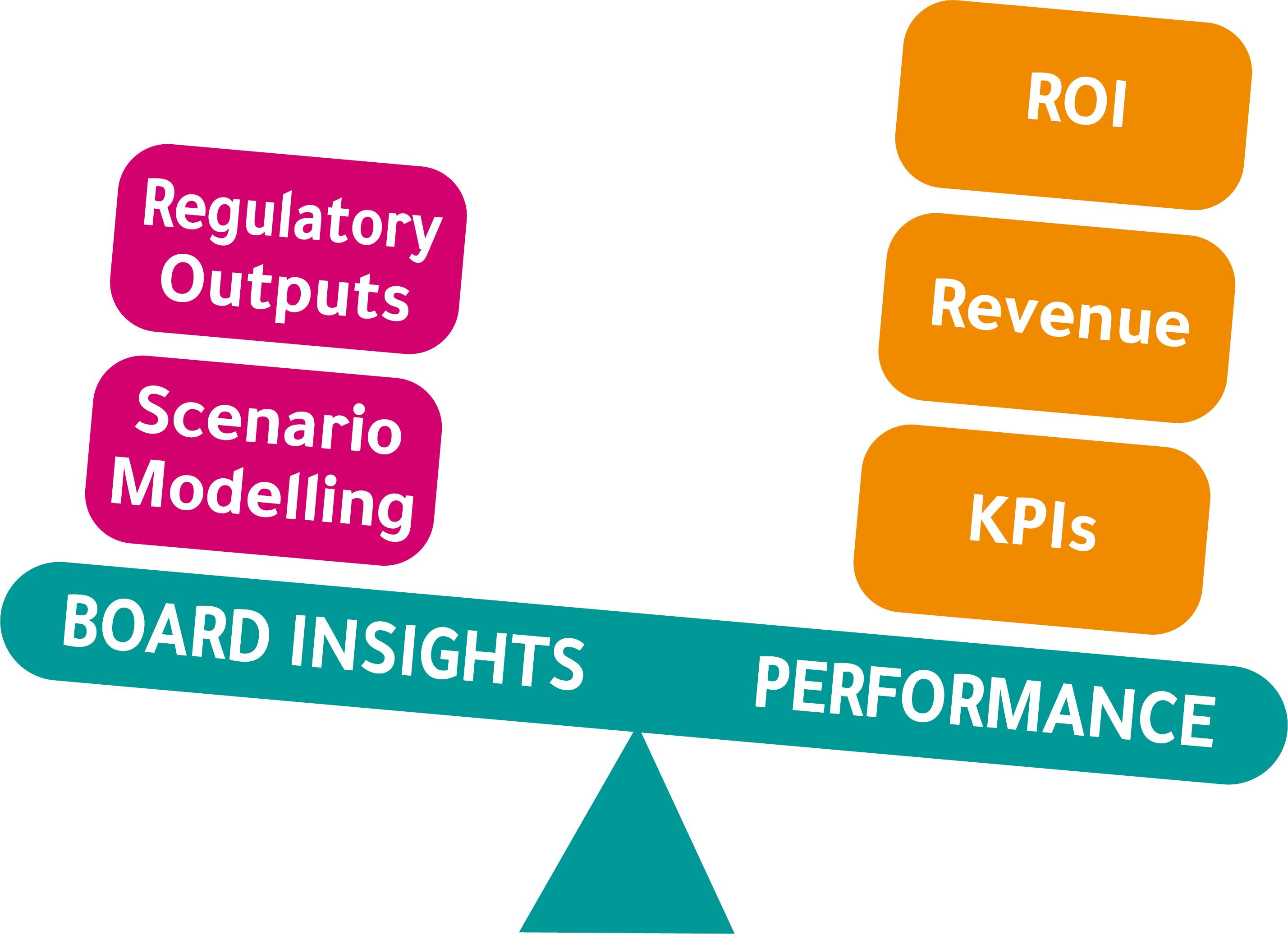

Accountagility’s ORYX solution empowers insurance companies to generate finalised profit and loss (PL) and balance sheet (BS) statements that adhere to multiple fiscal periods. This capability is especially beneficial for organisations that require reporting across different time frames. ORYX enables drill-down functionality to transactional data, allowing users to trace movements and gain insights into financial performance. Additionally, the platform offers the flexibility to export data to Excel for further analysis or presentation purposes.

Comprehensive Support for All IFRS Standards

While ORYX excels in supporting IFRS 17 compliance, it is important to note that Accountagility’s IFRS journal solution can be utilised across the finance function for all IFRS standards. This versatility makes it a valuable tool for insurance companies looking to streamline their financial reporting processes beyond IFRS 17.

Conclusion

The introduction of IFRS 17 has created a significant impact on insurance companies’ financial reporting requirements. Accountagility’s ORYX solution offers a robust platform that automates IFRS 17 reporting, ensuring consistency, transparency, and compatibility. It has features such as automatic journal production and posting, integration across finance systems, instant production of finalised PL and BS statements, and support for all IFRS standards. ORYX enables insurance companies to simplify their compliance processes and focus on delivering accurate and reliable financial information. Embracing ORYX can help organisations navigate the complexities of IFRS 17 with confidence, setting a strong foundation for future success.

Learn more about how ORYX can help with IFRS 17

Case Study – How one major insurance company is using ORYX to support IFRS 17

Book a demo for your IFRS 17 requirements