Many businesses have undergone digital transformations to improve their products, increase customer engagement and drive costs down in many parts of their organisation. But it is not uncommon to find finance departments continuing to operate in a traditional manner, using manual data collection and complex spreadsheets to manage important finance processes.

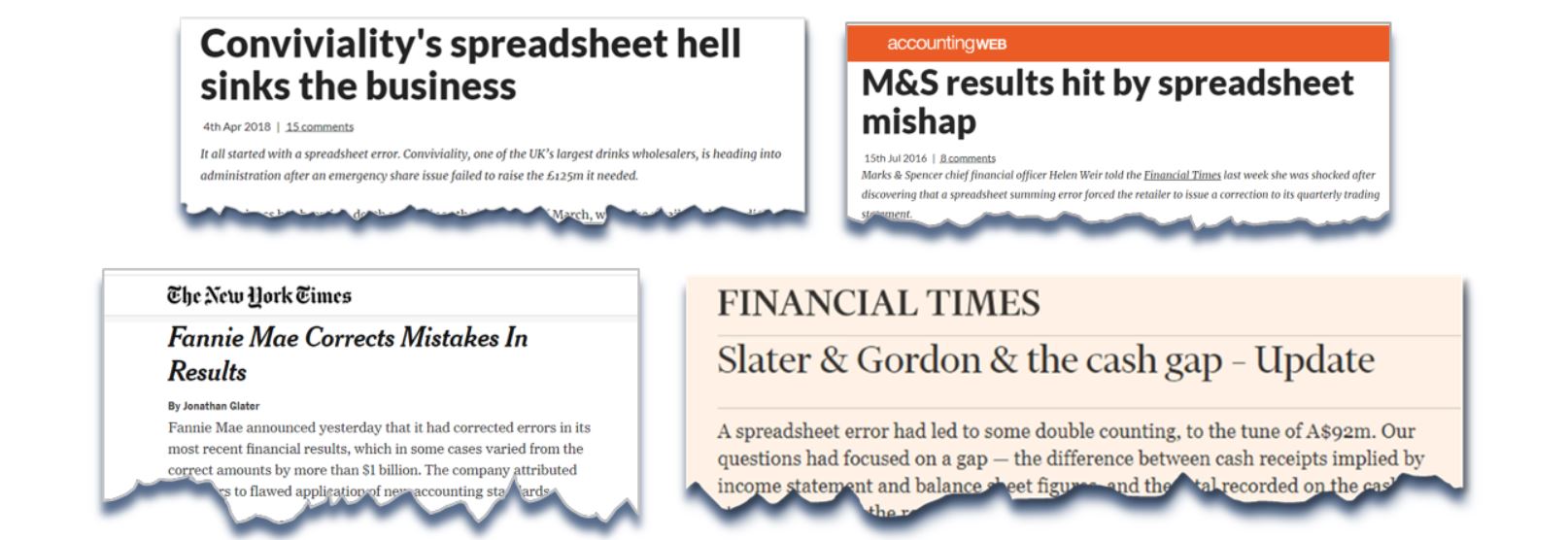

This can cost this central business function a lot in terms of time and resources, it also creates huge opportunities for errors. Nearly 20% of large businesses have suffered financial losses as a result of mistakes:

The most frustrating thing for companies impacted by such embarrassing issues, is to find the errors were easily preventable as they are caused by human error and/or spreadsheet errors, neither of which has any place in a modern digital business.

Today it is not just the cost of inefficient processes that is causing issues, but the Covid pandemic has exposed the weaknesses of manual processes per se, as spreadsheets with sensitive data are having to be emailed outside of the secure corporate network to facilitate remote working and effort required to consolidate the myriad of resulting copies and versions has skyrocketed.

As a result, finance departments are now racing to catch up with the rest of the business in their use of digitally enabled processes. One way to achieve this is to enhance Finance Process Automation software with robotic process automation (RPA) technologies.

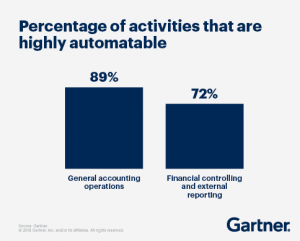

Gartner1 reports “89% of general accounting operations are highly automatable, and 72% of financial controlling and external reporting activities can be automated”.

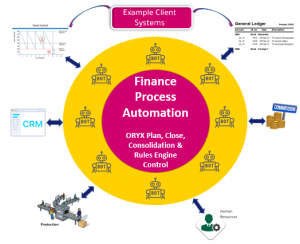

Accountagility’s ORYX software handles finance process automation such as consolidations, allocations, forecasting, report production, etc. If you also need to interact with multiple in-house applications such as ERP, manufacturing or CRM systems, RPA technology might be a useful augmentation toolset to separate the complexity of the infrastructure from the business process, rules and logic in ORYX.

There are a number of RPA software platforms available; Automation Anywhere, UIPath, Blue Prism, Nice, and many more. These add real value when wrapped around Software Automation solutions to remove mundane and time consuming activities such as data collection.

RPA technologies cannot fulfil the demanding and complex needs of the office of finance. But they are good to help with point solutions, particularly where there’s a requirements that does not warrant development of a strategic solution, for example, creating an interface with a legacy system that is due to be retired.

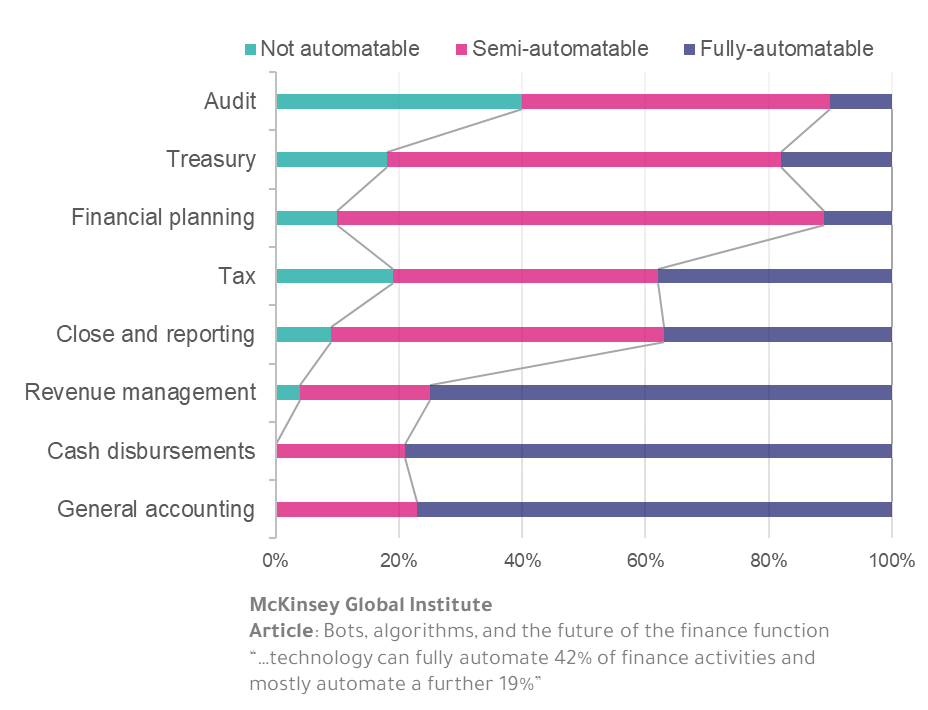

The opportunities for process improvement extend as McKinsey2 statistics illustrate potential areas for use and the benefits of finance process automation particularly well:

Finance Process Automation therefore not only removes errors and risk, but leads to a reduction in time and cost. Typical benefits a CFO or an FD can expect are:

- 100% human errors eliminated

- 20-30% cost reduction

- 100% process repeatability

- 2-3 x faster reports

- More fulfilling roles resulting in an uplift in staff morale

- Removal of business risk from errors in spreadsheets and manual processes

ORYX enables finance departments to work more productively by removing the risk, complexity and cost associated with inefficient processes by:

- Simplifying processes through standardisation

- Removing cost and risk through task automation

- Improving insights through data visualisation

- Introduction of RPA in finance as point solutions to improve repetitive processes

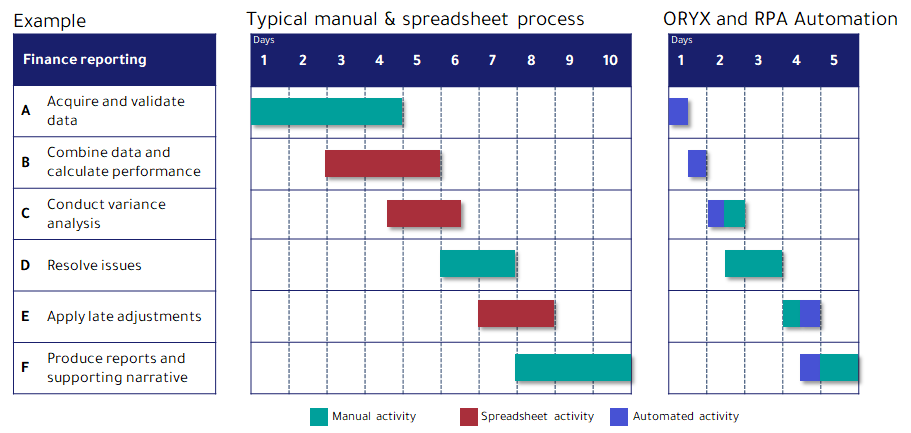

We have achieved some outstanding results with organisations saving £100k’s and operating at far greater efficiency than previously dreamt possible. Here is an illustration of how the time, cost and effort reduces for an example finance reporting process:

The most advanced finance organisations are now taking advantage of automation, but most companies we talk to state that less than 25% of the potential has been addressed, and the full scale of the opportunities have not been realised. Here are some of the initial key areas of improvement we provide to clients:

- Advanced analytics for variance analysis – compare at a glance different scenarios of your financial reports – watch our 90 second video illustrating this advantage

- Data visualization and dynamic dashboards – access all your daily information from a single screen – watch our 90 second video illustrating this advantage

- Collaboration and business engagement – flag issues and assign tasks efficiently to colleagues, regardless of different time zones or geographic locations, with complete revision control and auditability – watch our 90 second video illustrating this advantage

- Process automation and robotics – there are areas where businesses can reap advantages of finance process automation software with integrated RPA in finance – contact us and we’ll explain when and where RPA is best served in your finance office

Finance Process Automation is ready to reshape the future of finance; it’s your opportunity to boost performance, eradicate errors and get you the numbers you can trust. If you’d like to know more get in touch.

Sources:

McKinsey2 Bots, algorithms, and the future of the finance function, January 2019