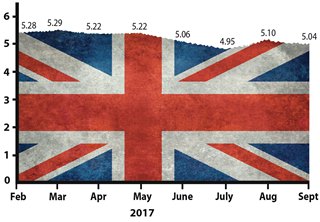

After the rise back into the black last month, the UK remains just in the positive zone with a score on the Accountagility Index (AAX) for September of 5.04. The Index records UK political and economic health in a score out of ten, and any score above 5.00 is positive.

The Index last month was 5.10, so it dropped 6 basis points during an unusually quiet period for post-Brexit Britain. Parliament has been in recess and most indices have not moved materially. Of course the Brexit talks with the EU continue to create headlines, and there is a concern that little measurable progress to date has been made. Amongst data that did change were confidence in the UK Manufacturing sector at a four-month high, due to help from exports with sterling at a 20% discount to pre-Brexit levels; improved employment levels; and some encouragement around future trade deals outside the EU.

September Brexometer Reading

On the other hand, confidence in the key Services sector dropped, hiring in the South of England has gone flat, new orders in Construction are dipping, and markets have slipped from their highs of July. Predictions for economic growth next year have declined too. All worrying signs on the horizon.

As indicated last month, however, the current peak in the inflation cycle is not sustainable as the main fall in sterling will drop out of the calculation by October.

The Accountagility Index Rating for September

How will the other factors change over the coming weeks? What will October bring? Can the Brexometer stay above 5.00? Keep following the Brexometer to find out.

What makes up the Accountagility Index (AAX)?

The data used to calculate the Accountagility Index are based on eleven key factors, all derived from a diverse range of independent and credible sources

- UK economic growth – A key building block of UK prosperity

- Markets – Reflects the health of larger British companies

- UK inflation – An important measure which needs to be carefully monitored

- Sterling strength – Affects imports, exports and confidence

- UK employment – Impacts so many aspects of UK economic activity

- UK Debt ratio – Tracks the UK’s progress against long term balancing of the books

- FDI (Foreign Direct Investment) – Illustrates the practical confidence levels from outside the UK

- Sentiment – Can be often the most important factor in how the economy is perceived

- Political stability/environment – A must include measure which can have instant impact on the big picture

- Progress on Brexit negotiations – Casts a very long shadow over all things

- Progress of International trade talks – A vital indicator of the UK’s international positioning