Although the UK voted to Brexit in June 2016, it will be at least two years, and possibly into the next decade, before the process is complete. There will be a long period before there’s clarity on where the UK will end up, with an enormous question mark hanging over the UK’s economic future.

To help CFOs assess the UK business environment and support their planning processes through these changeable times, Accountagility has introduced a Brexit barometer – the Accountagility Brexometer, and the Accountagility Index (AAX).

Introducing the Brexometer – helping Executives plan through changeable conditions

Every month, we will use a mix of eleven key factors to monitor the relative business and economic climate in the UK. Statistics are taken from a range of official independent sources, and combined with three softer measures, they form a comprehensive picture of the health of the UK economy and UK business.

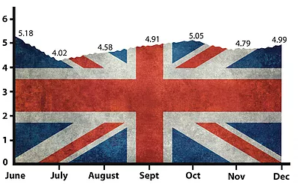

A visual representation of these are shown in the Accountagility Brexometer. The reading for November is 4.79 out of ten, down from 5.05 in October. To find out what that means, read on…

The Accountagility Index (AAX)

The chart below shows how the Accountagility Index (AAX) had moved since the EU referendum in June. Anything above 5 is positive. The seismic events of early Nov (High Court requiring MPs to vote on Brexit, with possibilities of general election, constitutional crisis, and Brexit decision being overturned) have had an impact on the month’s reading, and together with higher inflation numbers, it shows a marked deterioration in the Index back to where it sat in late August.

Starting in the month of the Referendum, we see that the Index was above half way (5.18). Then it declined to around 4 before recovering to a high of just above 5 last month. Are we now on another rollercoaster, with the Index once again below 5?

What makes up the Accountagility Index (AAX) ?

The data used to calculate the Accountagility Index are based on eleven key factors, all derived from a diverse range of independent and credible sources

- UK economic growth – A key building block of UK prosperity

- Markets – Reflects the health of larger British companies

- UK inflation – An important measure which needs to be carefully monitored

- Sterling strength – Affects imports, exports and confidence

- UK employment – Impacts so many aspects of UK economic activity

- UK Debt ratio – Tracks the UK’s progress against long term balancing of the books

- FDI (Foreign Direct Investment) – Illustrates the practical confidence levels from outside the UK

- Sentiment – Can be often the most important factor in how the economy is perceived

- Political stability/environment – A must include measure which can have instant impact on the big picture

- Progress on Brexit negotiations – Casts a very long shadow over all things

- Progress of International trade talks – A vital indicator of the UK’s international positioningoning