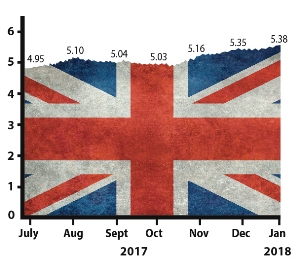

The UK has remained cool, calm and collected over the Yuletide break, climbing a modest three basis points since December to record a score of 5.38 on the Accountagility Index (AAX). Whilst this is technically an all-time high, the trend this month is flat. The Index records UK political and economic health in a score out of ten, and any score above 5.00 is positive.

January Brexometer Reading

The key drivers have been muted over the midwinter holiday period, but markets are continuing to rise, UK debt is dropping and inward investment is creeping up. To compensate for these factors, there was a drop in the Pound. Looking at how sentiment ended the year is instructive, as it conveyed simultaneous positive and negative messages across all three segments of Services, Manufacturing and Construction. There was a sharper rise in business activity in Services, but then again new order growth fell to a 16 month low. In Manufacturing, there was a solid end to the year but confidence fell, and input inflation is rearing its ugly head. In Construction, residential building orders are up, creating new jobs, but work is falling for commercial projects. Pick the bones out of that! The truth is, the entire picture is a patchwork quilt.

The Accountagility Index Rating for January

Other measures were neutral this month. Of course the Parliamentary recess contributes to the sense of calm.

Whilst this is all encouraging, there are still many uncertainties. Will Theresa May regain control of her party? What will the resumption of the EU talks bring? What other excitements will this New Year bring? Can the Index continue on its upward path?

Keep following the Brexometer to find out.

What makes up the Accountagility Index (AAX)?

The data used to calculate the Accountagility Index are based on eleven key factors, all derived from a diverse range of independent and credible sources

- UK economic growth – A key building block of UK prosperity

- Markets – Reflects the health of larger British companies

- UK inflation – An important measure which needs to be carefully monitored

- Sterling strength – Affects imports, exports and confidence

- UK employment – Impacts so many aspects of UK economic activity

- UK Debt ratio – Tracks the UK’s progress against long term balancing of the books

- FDI (Foreign Direct Investment) – Illustrates the practical confidence levels from outside the UK

- Sentiment – Can be often the most important factor in how the economy is perceived

- Political stability/environment – A must include measure which can have instant impact on the big picture

- Progress on Brexit negotiations – Casts a very long shadow over all things

- Progress of International trade talks – A vital indicator of the UK’s international positioning