Gathering inflation and Scottish threat to the Union stop the run…

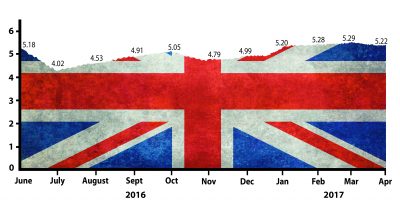

After last month’s small increase, the positive run in the Accountagility Index (AAX) that started last November, has come to a shuddering halt. The Brexometer reading for April stands at 5.22, down from last month’s 5.29 level.

April Brexometer Reading

Whilst the overall picture was encouraging with employment, markets, business confidence and foreign investment all rising, there was a significant rise in inflation (CPI was up 60 basis points to 3.2% and RPI up by half a percentage point to 2.3%)

The additional complexity of the political scene, and the reduction in political stability as a result of the request for another Scottish independence referendum also pushed the Index down, as did the drop off in economic growth, to just below 2%.

The Accountagility Index Rating for April

The general picture is very mixed, with some positive signals easing, but analysts are predicting a stronger pound over the coming months. Will this also cause inflation to subside? The Brexit gun has been fired, but there is no let-up in the uncertainty about the negotiations. So the forces of bull and bear continue to compete…

As predicted, March was certainly an action-packed month, with many developments. Nevertheless, the Brexometer continues in positive territory. Any figure above 5.00 is positive.

What will April and the coming months bring? Can the UK spring back again, now that the winter is behind us? Keep following the Accountagility Index to see whether the economic climate will also improve during Q2.

What makes up the Accountagility Index (AAX)?

The data used to calculate the Accountagility Index are based on eleven key factors, all derived from a diverse range of independent and credible sources

- UK economic growth – A key building block of UK prosperity

- Markets – Reflects the health of larger British companies

- UK inflation – An important measure which needs to be carefully monitored

- Sterling strength – Affects imports, exports and confidence

- UK employment – Impacts so many aspects of UK economic activity

- UK Debt ratio – Tracks the UK’s progress against long term balancing of the books

- FDI (Foreign Direct Investment) – Illustrates the practical confidence levels from outside the UK

- Sentiment – Can be often the most important factor in how the economy is perceived

- Political stability/environment – A must include measure which can have instant impact on the big picture

- Progress on Brexit negotiations – Casts a very long shadow over all things

- Progress of International trade talks – A vital indicator of the UK’s international positioning