The UK is biding its time this month.

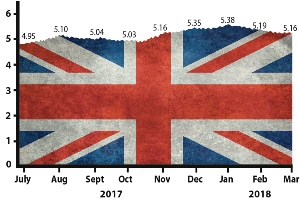

Whilst the March reading of the Accountagility Index (AAX) saw a second successive fall, the value of the drop to 5.16 from 5.19 was only 3 basis points. The Index records UK political and economic health in a score out of ten, and any score above 5.00 is positive.

March Brexometer Reading

March sees a continuation of conflicting messages observed over the past few months:

- GDP has dropped to 1.5% (as per the IMF forecast for 2018) and 1.4% (last twelve months’ actuals)

- But business sentiment is up, aligned to modest gains in the FTSE 250

The Brexit process is still a source of worry for many, and recent statements by EU and UK spokespersons pinpoint significant differences between the sides. Depending on your viewpoint, it is either “EU bullying” or “lack of clarity in the UK stance”. Other measures of note this time are signs that the stubborn inflationary hump may be past its peak, and a healthy reduction in the UK debt ratio as government income increases.

The Accountagility Index Rating for March

Putting a magnifying glass to the sentiment changes is illuminating. There was a faster rise in Services orders, leading to job creation, with business-to-business sales growth prominent. On the flipside, manufacturers’ confidence has been falling since last November; yet even here there is good news as orders from export markets like USA, China and Europe are up (not that you would see this based on the headlines). Construction companies are fretting about cost pressures, but are seeing a small increase in output. In summary, another month of a colourful patchwork quilt!

Next month, will we see a spring in the step or will we be dancing with an April fool? Will the Brexit music start? How will failures in the High Street and in the outsourcing sector affect the tempo?

Keep following the Brexometer to find out.

What makes up the Accountagility Index (AAX)?

The data used to calculate the Accountagility Index are based on eleven key factors, all derived from a diverse range of independent and credible sources

- UK economic growth – A key building block of UK prosperity

- Markets – Reflects the health of larger British companies

- UK inflation – An important measure which needs to be carefully monitored

- Sterling strength – Affects imports, exports and confidence

- UK employment – Impacts so many aspects of UK economic activity

- UK Debt ratio – Tracks the UK’s progress against long term balancing of the books

- FDI (Foreign Direct Investment) – Illustrates the practical confidence levels from outside the UK

- Sentiment – Can be often the most important factor in how the economy is perceived

- Political stability/environment – A must include measure which can have instant impact on the big picture

- Progress on Brexit negotiations – Casts a very long shadow over all things

- Progress of International trade talks – A vital indicator of the UK’s international positioning